Self Employed Income Worksheet For Mortgage

September 07, 2021Maurice SalinasIf you are self-employed you will have to hand over more documentation than a salaried borrower would. Self Employment Income If you have been self-employed more than two years enter the average monthly income from self-employment.

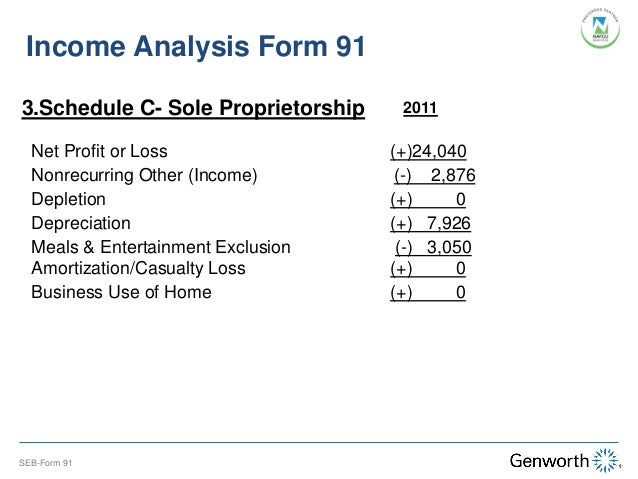

Self Employed Borrower Case Study Part I Completing The Form 91 Wit

Our income analysis tools are designed to help you evaluate qualifying income quickly and easily.

Self employed income worksheet for mortgage. Our cash flow analysis worksheets help you to easily and accurately determine a self-employed borrowers income. Self-employed borrowers have to hit the same credit income and asset marks that wage earners do although proving their income can be a bit more challenging. Ad Download over 20000 K-8 worksheets covering math reading social studies and more.

Las and t 2 years TrustCompany tax returns and Financial Statements inc. Rocket Mortgage by Quicken Loans can help you figure out which solution is right for your situation. Ad Save Thousands Of Dollars As An Expat On Government Surcharges.

Ad Find Self Employment Mortgage. Cash flow and YTD profit and loss P. Mortgage insurance Step 5 Enter monthly HOA homeowners association.

For employment and other types of income check out our Income Analysis worksheet. Borrow Up To 90. Rental Property Investment.

Cash flow analysis worksheets tax year 2020 Self-employed SAM Cash Flow Analysis with PL 02192021 Download the worksheet. Ad Save Thousands Of Dollars As An Expat On Government Surcharges. Guidance for the analysis and treatment of income for self-employed Borrowers as described in Chapters 5304 and 5305 2The Seller must determine that the total stable monthly income meets the requirements and guidance for the determination of stable monthly income in Topic 5300.

Analyze self-employed borrower cash flow income from employment and non-employment sources and rental income using our editable auto-calculating worksheets. Here are a few extra items youll need to provide. Income Analysis Worksheet for a calculation worksheet for self-employed borrowers.

Self Employed Applicants Income worksheet. Please note that these tools offer suggested guidance they dont replace instructions or applicable. Whether you are self-employed or a W-2 employee lenders want to see that your income is.

Our Experts Specialise In Australian Expat Home Loans. Discover learning games guided lessons and other interactive activities for children. Use our PDF worksheets to total numbers by hand or let our Excel calculators do the work for you.

Ad Download over 20000 K-8 worksheets covering math reading social studies and more. Both general and limited partnerships. Our editable auto-calculating worksheets help you to analyze.

Discover learning games guided lessons and other interactive activities for children. Required documentation for self-employed borrowers. W2s from your self-employed business if you pay yourself a salary Schedule C D E F.

Find Out If You Qualify. Expected to continue for at least three years. And t 2 years Partnership tax returns where applicants have earned income from any of these sources.

Find Out If You Qualify. 2 years personal tax returns with all schedules 1099s. See Part II Section 1a.

In order to apply for a mortgage while self-employed youll need to verify and document your income maintain a lower DTI and higher credit score. We get it mental math is hard. The Self-Employed Income Analysis Form 1084A or 1084B should be used to determine the borrowers share of the partnerships adjusted business income that will be available for qualifying the borrower for the mortgage if the borrower is able to provide evidence that he or she has access to the funds.

Borrow Up To 90. INCOME CALCULATION WORKSHEET PART I - INCOME TYPE Section Borrower Co-Borrower 1 Hourly. This includes but is not limited to business review and analysis.

Thats why Enact provides a collection of downloadable calculators and reference guides to help you analyze a self-employed borrowers average monthly income and expenses. Radians Self-Employed Cash Flow Analysis Calculator is designed to assist you in underwriting loan applications from self-employed borrowers for coverage with Radian mortgage insurance. If you have been self-employed less than two years you usually cannot use income from self-employment to qualify for a loan UNLESS you were previously employed in the same line of work before setting up your own company.

Our Experts Specialise In Australian Expat Home Loans. Self-Employed Borrower Tools by Enact MI. Profit Loss accounts and Balance Sheet Las.

Ad Find Self Employment Mortgage. And Last 2 years Personal tax returns and ATO Notice of Assessments for each applicant.